What Authors Need to Know About the New Tax Bills

November 29, 2017 Industry & Advocacy News

It’s a fast-moving target, but our lawyers and staff in New York and Washington are analyzing the proposed tax bills to see how they will affect authors. As we await a final Senate bill, given the amount of confusion, we wanted to let you know where things stand right now.

The principal changes to individuals’ income taxes proposed by both the House and Senate bills are 1) changes in tax rates, 2) the elimination of many specific, itemizable deductions and credits, and 3) the increase in the standard deduction. These changes are intended to streamline personal income taxes by limiting the number of those filing itemized deductions. It will make filing returns simpler for many taxpayers, and will benefit those who rely on the standard deduction. However, it will penalize those who currently have high deductible expenses, such as medical costs, dependent child care, and high local and state income and property taxes.

The types of itemized deductions and credits to be repealed differ somewhat under the Senate and House bills, and those differences are described below. Neither bill, however, would repeal self-employed writers’ ability to take standard business deductions—a source of some confusion since certain individuals who file as employees, such as “qualified performing artists,” would no longer qualify for unreimbursed business expense deductions under the proposed bills. This provision is applicable only to employees, and not freelancers.

Authors who file as self-employed individuals would still be able to deduct costs like any other business.

Some authors use an LLC or other pass-through corporations to contract with and be paid by publishers and others. There are also proposed changes that would affect pass-through corporations, which are still the subject of some debate. We will provide further updates on those as the bills progress.

Here is Where We Are in the Process

The House introduced, voted on, and passed House Bill H.R.1, the Tax Cuts and Jobs Act. The Senate introduced its own separate bill that differs in many respects, but which similarly reduces tax rates, removes certain types of deductions, and is also meant to simplify taxes to some extent. According to the Congressional Budget Office, the House bill is projected to increase the national deficit by $1.7 trillion over the next decade, while the Senate bill would increase it by $1.4 trillion. The Senate bill (which has now been approved by the Senate Budget Committee), is currently being amended to meet the demands of certain Senate Republicans. The Senate leadership hopes to bring the bill to vote later this week, probably Friday. The Senate and the House ultimately must vote on the same bill for it to become law so if the Senate votes to approve the bill, the next step is either for the House to vote on the Senate bill (and reportedly there is some pressure for it to do so), or the two houses must negotiate a compromise “conference bill.” Once the identical bill is adopted by both houses, it will be sent to the President for signature and becomes law.

The provisions that might be of interest to freelance authors are described below.

Tax Brackets

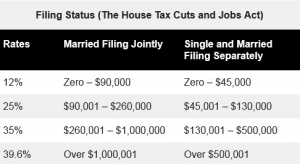

The House’s Tax Cuts and Jobs Act will reduce the number of tax brackets from seven to four, with rates of 12%, 25%, 35%, and 39.6%.

The House’s Tax Cuts and Jobs Act will reduce the number of tax brackets from seven to four, with rates of 12%, 25%, 35%, and 39.6%.

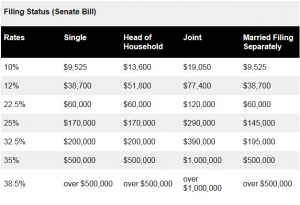

The Senate version of the Tax Cuts and Jobs Act, released on Friday, November 10, proposes a seven-rate bracket structure—10%, 12%, 22.5%, 25%, 32.5%, 35%, and 38.5%—three more than described in the House version.

Standard Deductions Raised

- The House bill would raise the standard deduction from $12,700 to $24,400 for married taxpayers filing jointly; from $9,350 to $18,300 for single filers with at least one qualifying child (head of household filers); and from $6,350 to $12,200 for single filers. This almost doubles the present standard deduction.

- Under the Senate bill, the standard deduction would be raised to $24,000 for married taxpayers filing jointly; to $18,000 for head of household filers; and to $12,000 for single filers. Like the House bill, the Senate’s proposed legislation nearly doubles the present standard deduction.

Homeowners/Mortgage Interest Deductions/State & Local Taxes

- The House proposal would cap the mortgage interest deduction at $500,000, reducing the current cap of $1 million. It would also eliminate the mortgage interest deduction for second homes.

- The Senate proposal would NOT make this change. The Tax Policy Center estimated that the percent of filers who claim the deduction would fall to 4% from 21% if the standard deduction doubles.

- The Senate’s tax plan would eliminate deductions for state and local taxes — including property taxes.

-

- The House plan, on the other hand, would also eliminate most state and local tax deductions, but it would preserve property tax deductions up to $10,000.

-

- Both proposals would be a serious hit to taxpayers in high-tax states like New York, California, New Jersey, and Connecticut.

- Some of the suggested changes would also mean homeowners could get hit with a bigger tax bill on the sale of their primary home. Current law allows sellers to generally exclude $250,000, or $500,000 for those filing jointly, from capital gains when selling a home if they’ve lived in it for two out of the past five years. Both the House and Senate want to increase the live-in time period to five out of the last eight years. The Senate bill allows for some exceptions to the time requirement, like if a seller is leaving due to a change in jobs or health care.

Dependent Care

- Under the House bill, the child tax credit is increased to $1,600. (Modified income limits will make the credit available to more families, but no portion of the increased amount will be refundable.) It creates two different $300 family credits, also non-refundable: one for non-child dependents, and one for each spouse if they file jointly, or in the case of a single parent or head of household, depending on income levels.

- The Senate bill increases the child tax credit from $1,000 to $2,000 (instead of $1,600 as in the House bill) and phases out at higher income levels to enable more parents to become eligible for the credit.

- The adoption tax credit would be eliminated under the House bill; but is retained under the Senate bill.

Medical Care

- The House proposal repeals the deduction for medical expenses. This could significantly impact freelancers, who disproportionately finance their own medical care. The Senate proposal would NOT repeal this deduction.

Tax Preparation

- Deduction for tax preparation expenses would be eliminated by the House bill.

Alimony

- Under the House bill there will be no deductions for alimony payments effective for any divorce decree or separation agreement executed or modified after 2017.

Individuals paid through Pass-through Business

- The House proposal would reduce the rate at which “pass through” individual business income is taxed; the tax rate would change for sole proprietorships, partnerships, LLCs and S corporations. Because freelancers’ income is typically taxed at the ordinary income rate, or rates up to 39.6%, this would benefit high-earning authors and adversely affect authors who are in lower tax brackets in a given year but are paid through an LLC. The House proposal would tax some of that income at 25% instead of at the personal tax rate.

- Under this House proposal, “self-employment” taxes of 15.3% generally would not apply to income qualifying for the new 25 percent rate. This “self-employment” tax consists of taxes paid entirely by a freelancer, such as Social Security and Medicare, which employers normally share the burden of.

If you have concerns about the bills, you can contact your local representatives. Many thanks to Robert Pesce CPA and his accounting firm, Marcum LLP (whose name you may recognize from our tax seminars), as well as our lobbyists at American Continental Group, for their help in summarizing the bills.